HI DoT N-35 2024-2026 free printable template

Show details

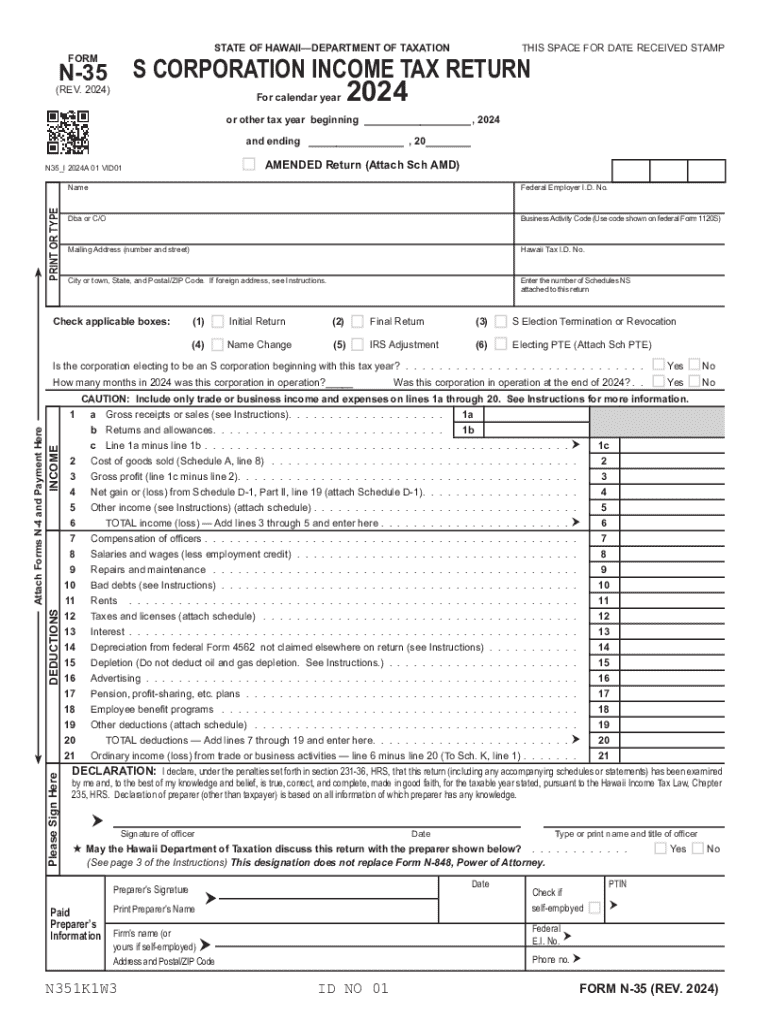

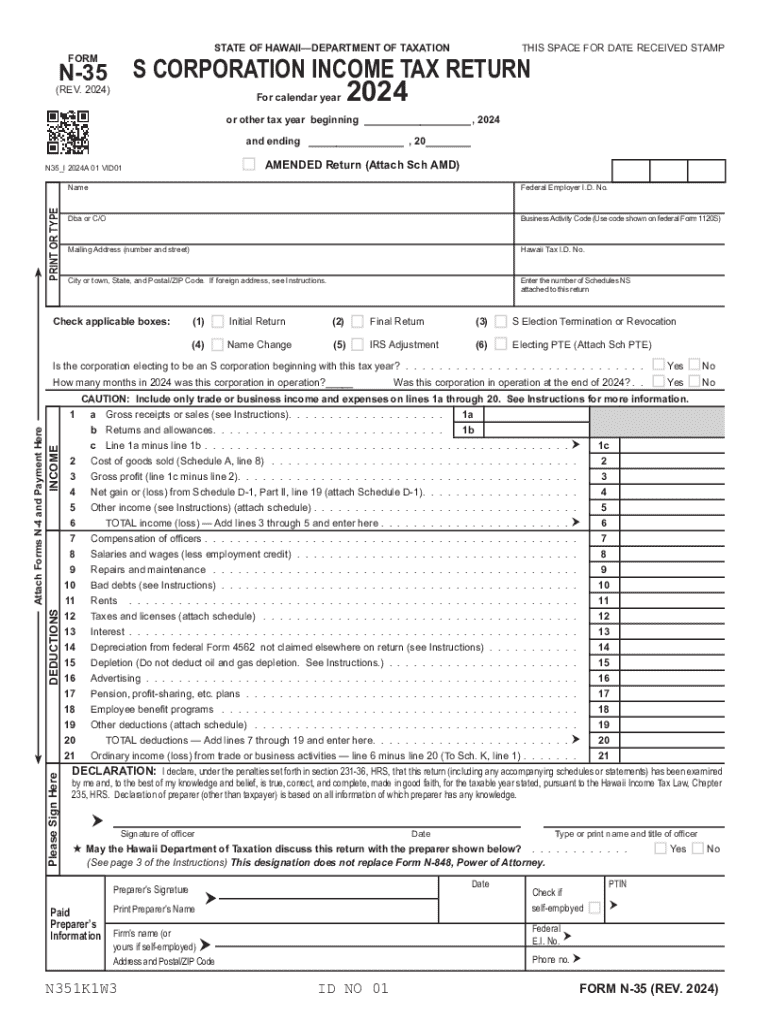

This document is a tax return form for S corporations in Hawaii, designed to report income, deductions, and other tax-related information for the tax year 2024.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hawaii form n 35

Edit your form n 35 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hawaii form n35 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hawaii n 35 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit hawaii form 35. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-35 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out n 35 form

How to fill out HI DoT N-35

01

Obtain the HI DoT N-35 form from the Department of Transportation website or local office.

02

Fill in your personal information at the top of the form, including name, address, and contact details.

03

Provide vehicle information, including make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the form in the designated section.

05

Complete any additional sections as required, such as odometer readings or details about previous registrations.

06

Review the form for accuracy and completeness before proceeding.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate agency either online, by mail, or in person.

Who needs HI DoT N-35?

01

Individuals who are registering a vehicle in Hawaii for the first time.

02

People transferring ownership of a vehicle previously registered in Hawaii.

03

Those updating their vehicle registration details with the Department of Transportation.

Fill

hawaii form n 35 instructions 2024

: Try Risk Free

People Also Ask about hawaii n 35 instructions 2024

Who is required to file a Hawaii tax return?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

What is the penalty abatement in Hawaii?

The Department of Taxation may waive any amount of penalty or interest that has been added to any delinquent tax if there has been an excusable failure to file a return or pay a tax within the time required by law, or if the entire amount due is uncollectible.

Who needs to file a Hawaii state tax return?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

Where can I get Hawaii state tax forms?

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators (FTA) Secure Exchange System (SES) website. The SES website is a secure way to provide files to those that reproduce our forms.

Which people are legally required to file a tax return?

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

What is the form N-35 in Hawaii?

Form N-35 is used to report the income, de- ductions, gains, losses, etc., of an S corporation doing business in Hawaii. Do not file Form N-35 until the corporation has been notified by the In- ternal Revenue Service (IRS) that the corpora- tion's election to be treated as an S corporation has been accepted.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send maryland permission to hunt form pdf for eSignature?

To distribute your HI DoT N-35, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out the HI DoT N-35 form on my smartphone?

Use the pdfFiller mobile app to complete and sign HI DoT N-35 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit HI DoT N-35 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share HI DoT N-35 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is HI DoT N-35?

HI DoT N-35 is a form used in Hawaii for reporting income tax information for non-resident individuals and entities engaging in business within the state.

Who is required to file HI DoT N-35?

Non-resident individuals and entities engaged in business activities in Hawaii that earn income from sources within the state are required to file HI DoT N-35.

How to fill out HI DoT N-35?

To fill out HI DoT N-35, taxpayers need to provide their identifying information, detail income earned in Hawaii, deduct eligible expenses, and calculate the tax owed based on Hawaii's tax rates.

What is the purpose of HI DoT N-35?

The purpose of HI DoT N-35 is to assess and collect income tax from non-resident individuals and entities on income sourced from Hawaii, ensuring compliance with state tax laws.

What information must be reported on HI DoT N-35?

HI DoT N-35 requires reporting of personal and business information, total income earned in Hawaii, allowable deductions, and calculated tax liability.

Fill out your HI DoT N-35 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT N-35 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.